In the midst of growing concern about climate change and the need to reduce greenhouse gas emissions, the transition to renewable energy sources has become a global priority. In this context, the Inflation Reduction Act (IRA) emerges as key legislation in the United States aimed at promoting the adoption and development of clean energies, with the goal of mitigating the effects of climate change and ensuring a sustainable energy future.

Enacted in 2022, the Inflation Reduction Act is a comprehensive piece of legislation designed to stimulate investment in renewable energy and expedite its implementation nationwide. The IRA focuses on reducing inflation in the energy sector and addresses a range of key challenges that have hindered the growth of clean energies.

With a particular focus on injecting funds into energy improvement programs and providing tax incentives, the IRA is generating significant momentum to accelerate the transition to cleaner and more sustainable energy sources. In this article, we will explore the general features of the IRA within the renewable energy sector.

Funding Injection for Energy Improvement Programs:

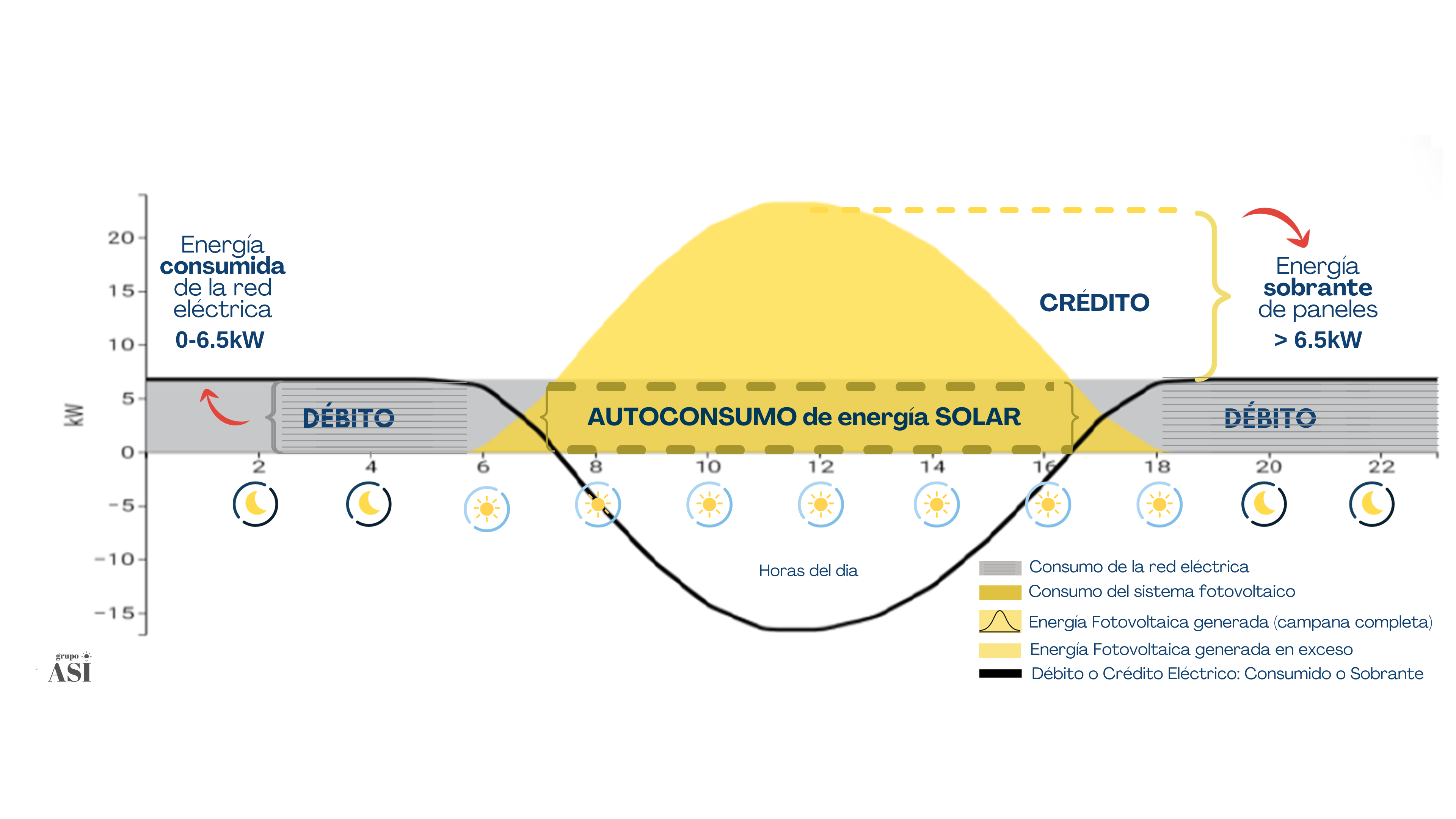

One of the fundamental pillars of the IRA is the allocation of financial resources for energy improvement programs. These programs are designed to assist households, businesses, and institutions in making upgrades and transitions to more efficient and sustainable technologies. This includes improvements in energy efficiency, the installation of solar panels, and the adoption of geothermal energy systems, among others.

The injection of funds into these programs enables a larger number of stakeholders to access clean energy solutions. By reducing initial costs and providing financial assistance, the IRA encourages widespread adoption of renewable technologies. This not only decreases the consumption of energy from fossil fuels but also helps reduce long-term energy bills, enhancing efficiency and sustainability in the use of energy resources.

Tax Incentives to Promote Renewable Energy:

Another powerful tool contained in the IRA is tax incentives aimed at encouraging investment in renewable energy. These incentives can take various forms, such as tax credits, exemptions, and deductions. By reducing the tax burden associated with the adoption of clean energies, the IRA makes it more attractive for individuals and businesses to invest in renewable technologies.

Tax incentives help level the playing field and overcome economic barriers that often hinder the adoption of renewable energy. By reducing installation and operation costs, tax incentives provide investors with a higher long-term return on investment. This not only stimulates demand for renewable technologies but also drives innovation and economic growth in the clean energy sector.

The combination of funding injection into energy improvement programs and tax incentives has a significant impact on boosting renewable energy and generates a series of environmental and economic benefits.

Economic Impacts:

In economic terms, the IRA drives job creation in the renewable energy sector as the demand for specialized labor increases. Additionally, by reducing energy bills and promoting energy efficiency, businesses and households can allocate more resources to other areas of the economy, stimulating growth and investment in different sectors.

Moreover, the IRA includes measures to promote research and development of renewable energy technologies. Significant funds will be allocated to research in areas such as energy storage, energy efficiency, and the development of new clean technologies. These efforts aim to spur innovation in the sector and ensure that renewable energies become increasingly efficient and cost-effective.

Another important aspect of the IRA is the implementation of stricter standards for carbon emission reduction in power generation. Clear goals and timelines will be set for the gradual phase-out of fossil fuel power plants, promoting the transition to renewable sources such as solar, wind, hydroelectric, and geothermal. This will not only help reduce dependence on fossil fuels but also create jobs in the clean energy sector and improve air quality and public health.

The Inflation Reduction Act, through its focus on funding injection into energy improvement programs and tax incentives, plays a crucial role in boosting renewable energy. These measures increase access to clean technologies, reduce dependence on fossil fuels, and promote energy efficiency. At the same time, the environmental and economic benefits associated with the adoption of renewable energies become increasingly evident. The IRA positions itself as a key tool in accelerating the transition to a sustainable and promising energy future.