In an increasingly sustainability and environmentally responsible-focused world, small businesses are constantly seeking ways to implement environmentally friendly practices and technologies. However, they often encounter financial challenges when trying to undertake sustainable projects. In this context, the Small Business Administration’s (SBA) Green Loans have emerged as a valuable solution to support small businesses in their transition towards sustainability and energy efficiency.

What is a Green Loan?

The SBA Green Loans program offers loans through SBA-certified lenders designed to help small businesses finance energy efficiency improvements and projects that promote environmental sustainability. These loans offer a series of benefits that facilitate access to financing and encourage the development of sustainable projects.

Funds and Eligibility

- Eligible projects can access a maximum of $5,500,000.

- Projects for existing energy consumption reduction by at least 10%.

- Renewable energy sources that generate more than 15% of the energy used in project facilities or increased use of sustainable designs.

- Gross Debentures issued for a small business, including affiliates, for eligible projects must not exceed $16,500,000.

- The $5,500,000 limit for each project is not reduced by any other SBA-guaranteed loans that the borrower and its affiliates have received through other SBA loan programs.

- Loans granted to eligible projects do not reduce the $5,000,000 limit for each small business in other SBA 504 programs.

Benefits

- Favorable terms and conditions: SBA Green Loans offer favorable terms and conditions for small businesses. These loans usually have lower interest rates and longer repayment terms compared to traditional loans, allowing businesses to save money and maintain better long-term financial stability.

- Flexible repayment requirements: The program also offers flexible repayment requirements, relieving the financial burden for participating businesses. This allows them to reap the benefits of energy savings and cost reduction before starting to fully repay the loan.

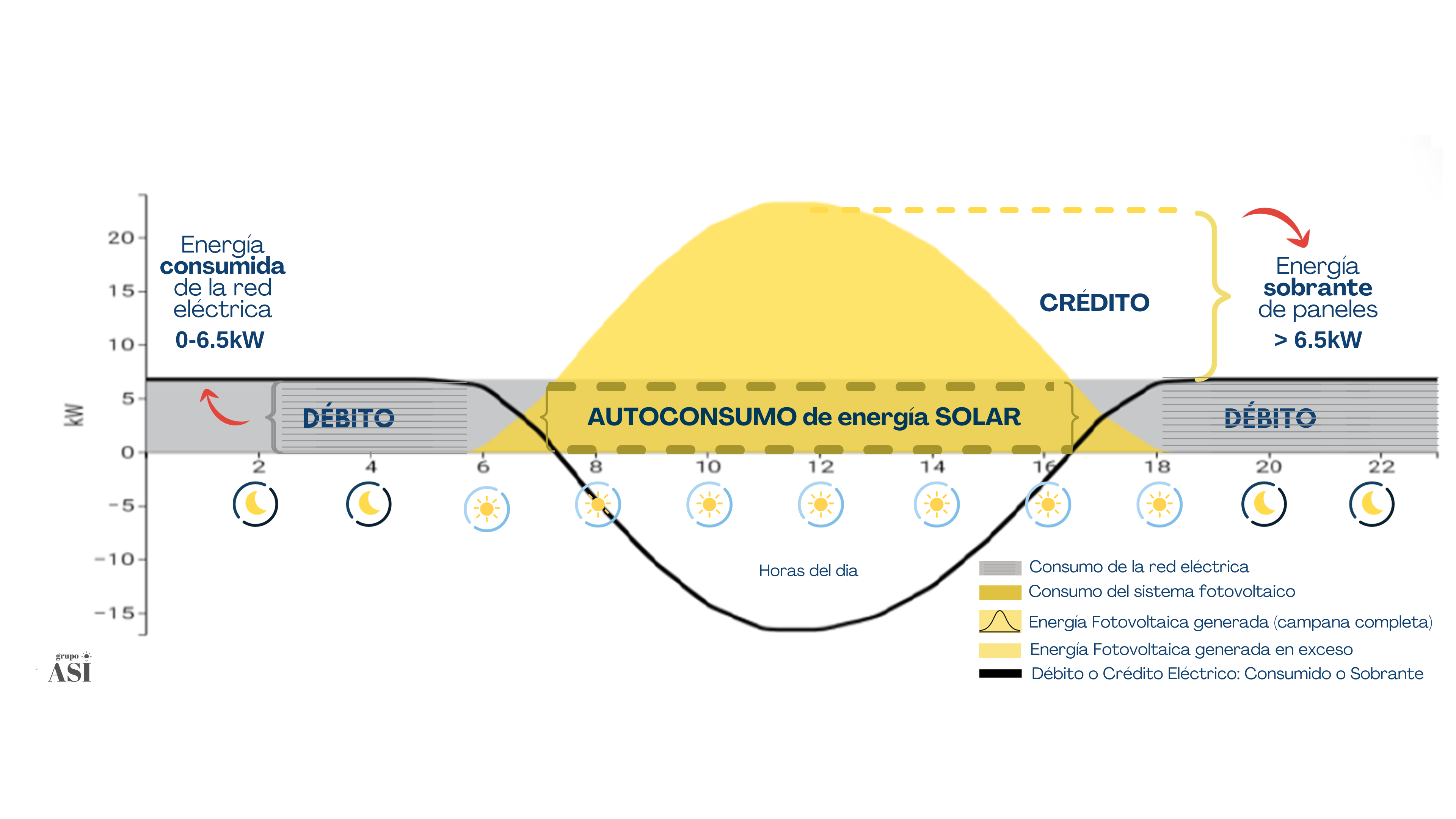

- Comprehensive financing: The program covers a wide range of eco-friendly projects, such as energy efficiency improvements, installation of solar panels, geothermal energy systems, air quality improvements, and water conservation projects. This provides businesses with the opportunity to implement customized solutions tailored to their specific needs.

- Advice and technical support: In addition to financing, SBA Green Loans offer advice and technical support to businesses. This includes educational resources, assistance with loan applications, and guidance on implementing sustainable projects. This additional support helps businesses make informed decisions and maximize the success of their sustainability initiatives.

- Contribution to economic and environmental development: By leveraging SBA Green Loans, businesses not only gain financial benefits but also contribute to economic and environmental development. By implementing sustainable projects, businesses reduce their carbon footprint, save natural resources, and can even generate long-term savings on operating costs. Additionally, these initiatives foster job creation in clean energy and sustainability-related sectors.

How do I access a Green Loan?

SBA Green Loans are available through SBA-certified lenders. Interested small businesses can seek out participating lenders in their area and submit an application to assess their eligibility. It is recommended to contact your regional SBA office for guidance.

SBA Green Loans represent a valuable financial option for small businesses seeking to implement sustainable projects and reduce their environmental impact. By offering favorable terms and conditions, technical support, and a wide range of financeable projects, these loans facilitate the adoption of sustainable practices in the business environment. By leveraging SBA Green Loans, small businesses can not only strengthen their financial position but also contribute to building a more sustainable and resilient economy.