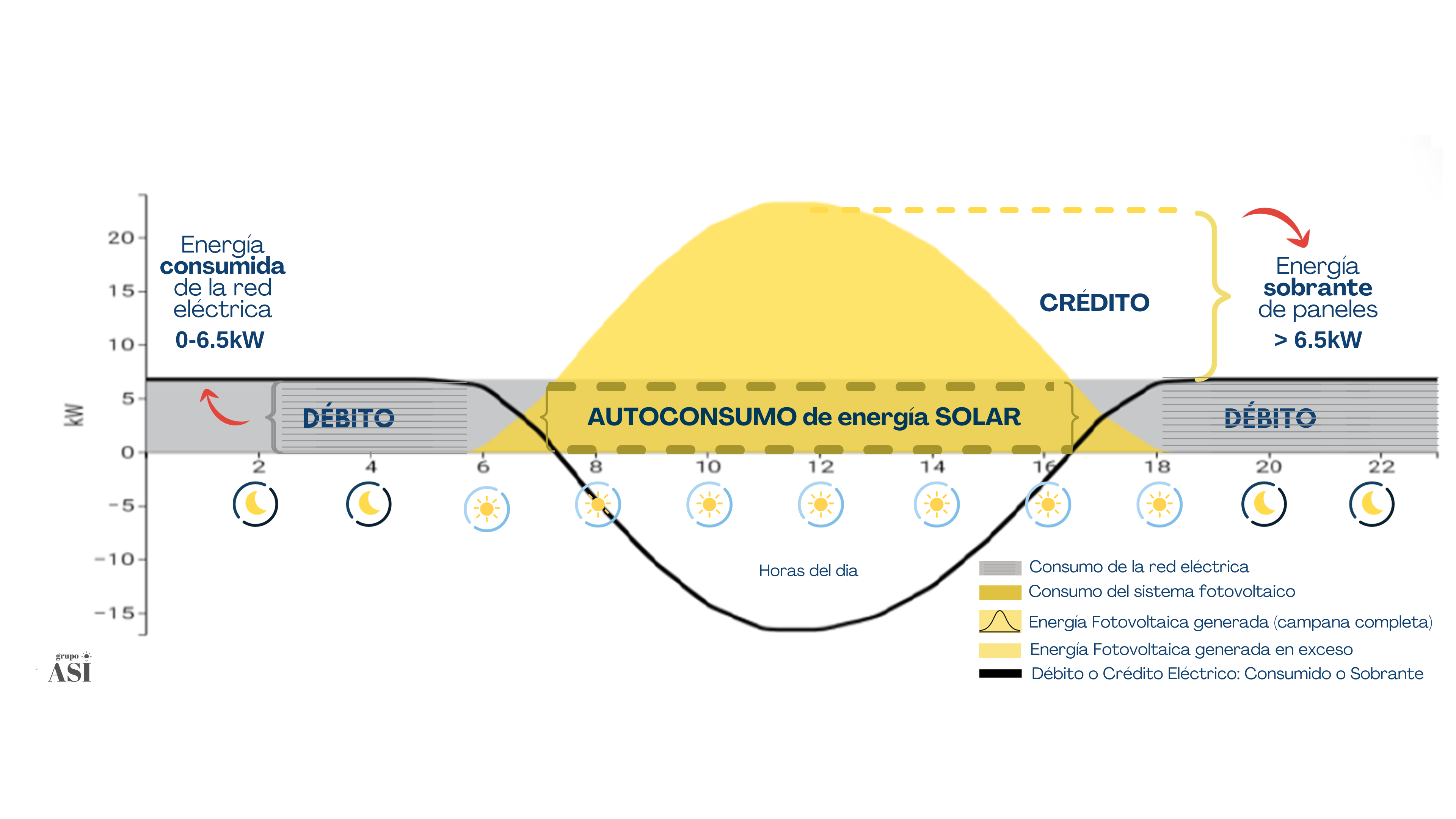

One of the observed trends at the island level is the search for resilience and reduction of operational costs related to electrical energy in Puerto Rico. In this pursuit, Puerto Rico is taking significant steps towards promoting green energy and sustainable practices. The Puerto Rico Incentives Code (PR-IC) offers a variety of benefits for companies involved in activities related to green energy on the island. By encouraging the adoption of renewable energy sources such as wind, solar, geothermal, biomass, hydroelectric, and more, Puerto Rico aims to create a cleaner and more sustainable future. This incentive seems to present an opportunity for local businesses.

According to the PR-IC, companies engaged in the production or sale of green or highly efficient energy on a commercial scale in Puerto Rico may be eligible for tax benefits. These benefits also extend to entities dedicated to the assembly, installation, or leasing of equipment for the production of green or highly efficient energy.

To qualify for these tax benefits, companies must first obtain certification as an electric company from the Puerto Rico Electric Power Authority (PREPA) or its successor. Once certified, companies can enjoy:

- A 4% tax on profits from the sale of stocks, membership interests, or most assets.

- A 12% income tax withholding on royalty payments made to non-resident entities or individuals in Puerto Rico for the use or right to use certain intangible assets in Puerto Rico.

- A 100% exemption from income tax on liquidating distributions.

- A 100% exemption from property tax during the first fiscal year of operations.

- A 100% exemption on certain items, such as raw materials, machinery, equipment, and fuels used (especially in the generation of green or efficient energy).

Some items, such as raw materials, machinery, equipment, and fuels used in Exempt Activities (especially in the generation of green or efficient energy), are not subject to the Sales and Use Tax (SUT).

A 100% exemption from income tax and a minimum net income contribution exemption for interest derived by a lender of funds used for the development and construction of properties that will be used.

A current deduction for amounts incurred in the purchase, acquisition, or construction of machinery and equipment, and the construction of buildings and structures.

One of the key benefits that local businesses can take advantage of is the exemption from capital gains taxes. This means that if you decide to sell or exchange stocks or assets from your business, you would only have to pay a 4% tax instead of the standard rate. This advantage can be especially valuable for small businesses looking to expand or diversify their operations.

Additionally, the PR-IC offers a 100% exemption from property tax during the first fiscal year of your green energy business operations. This means significant savings on tax costs while establishing your green energy company. Expenses related to the purchase, acquisition, or construction of machinery and equipment, as well as the construction of buildings and structures, are currently deductible, allowing you to reduce your tax burden.

Another important aspect is the generation of Renewable Energy Certificates (RECs) by companies producing green energy. These certificates are tangible assets with economic value and equate to 1 MW of electricity generated from green or highly efficient energy sources. RECs can be sold, transferred, or traded, providing local businesses with the opportunity to earn additional income through the commercialization of these assets.

In summary, Puerto Rico offers attractive tax incentives for companies involved in green energy activities on the island. These incentives range from tax benefits on asset sales to exemptions from income, property, and other taxes. Furthermore, local businesses generating RECs can benefit from their commercialization. These initiatives support the development of a sustainable energy industry and promote a cleaner and more prosperous future for Puerto Rico.